HME Business 2016 Annual Industry Forecast

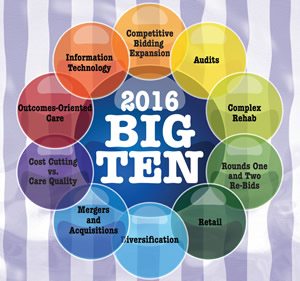

2016 Big Ten

Several key trends will impact the industry in 2016. What should providers anticipate, and how should they prepare?

- By David Kopf

- Jan 01, 2016

Kheng Guan Toh/shutterstock.com

At the start of each year, HME Business makes it a point to profile 10 trends that will shape the months ahead. As 2016 comes into focus, we can say one thing with certainty: much is at stake. As this issue goes to press, the fate of the industry’s efforts to reform CMS’s nationwide expansion of competitive bidding remains unresolved. How that will play out could have serious ramifications for providers in non-bid areas, and especially those in rural areas.

And beyond that, there are other key issues and trends that are radically reshaping the world of home medical equipment. For this year, we are certain that providers will need to shape their business strategies around the following:

- National Expansion of Competitive Bidding

- Re-bids of Rounds One and Two

- Complex Rehab

- Audits

- Retail

- Diversification

- Mergers and Acquisitions

- Information Technology

- Outcomes-Oriented Care

- Cost Efficiencies vs. Care Quality

Let’s examine how these trends will shape HME during 2016:

National Expansion of Competitive Bidding

National Expansion of Competitive Bidding

At the risk of sounding overdramatic, as this issue goes to press, the fate of rural providers and patients hangs in the balance. Starting Jan. 1 CMS was slated to expand competitive bidding prices to all to claims for HME/DME that are non-bid areas. In terms of pricing, CMS will use an un-weighted average of all of the single payment amounts (SPAs) for each of the categories from the CBAs to determine a regional single payment amount (RSPA) for each covered item. From Jan. 1 to June 30, reimbursement for affected product categories will be based on 50 of the current, un-adjusted fee schedule, plus 50 percent of the RSPAs. Then, on July 1, the rates will drop to fully implement the bidding-derived rates.

For rural providers — along with providers in non-bid areas — this translates into an approximate 46 percent average cut to their reimbursement. However, rural providers have fewer options because their market opportunities are dictated by their geography. If those providers are unable to find any additional volume to make up for the, their businesses could falter, which could in turn jeopardize their patients’ access to care.

So, as this issue was going to press, providers and industry associations were advancing two pieces of legislation: H.R. 4185, The Protecting Access through Competitive-pricing Transition (PACT) Act, launched by Reps. Tom Price (R-Ga.) and Tammy Duckworth (D-Ill.); and S. 2312, the DME Access and Stabilization Act, which was introduced by Sens. Senators John Thune (R-S.D.) and Heidi Heitkamp (D-N.D.). Those bills would:

- Apply a 30 percent increase to single payment amounts (SPA), calculated on a regional basis, for suppliers in non-bid areas.

- Phase in the bidding-derived pricing over a two-year period in non-bid areas, rather than CMS’s six-month phase-in.

- Set the ceiling for future bidding rounds of the competitive bidding program at the unadjusted fee schedule rates that went into effect on Jan. 1, 2015, instead of CMS’ proposal to set a bid ceiling at the previous bid amount rates. The AAHomecare noted this is an important component of the legislation that will benefit all providers subject to competitive bidding rates in future bidding rounds.

- Instruct CMS to revisit pricing adjustments for non-bid areas that takes into account travel distance, clearing price and other associated costs for furnishing this equipment for prices that will be in effect on Jan. 1, 2019.

The House bill would also implement a Market Pricing Program (MPP) demonstration project in order to compare an alternative methodology for achieving sustainable savings while preserving access to medically necessary equipment, supplies, and services to beneficiaries.

As you read this, the fate of that legislation could have been determined, but the outcome for rural providers and patients will still have yet to unfold. If passed, will SPA plus 30 percent be enough to protect rural providers? If not passed, will rural providers be able to find a way to survive, or will they have to make some difficult business decisions? (HME Business is crossing its fingers for the former.)

Re-bids of Rounds One and Two

Re-bids of Rounds One and Two

The expansion of competitive bidding isn’t the only competitive bidding development that will unfold in 2016. CMS’s re-compete of Round Two is well underway and will be implemented this year, and the re-compete of Round One for 2017 contracts will see significant forward momentum during 2016, as well.

Starting with Round Two of competitive bidding, the bid window closed back in March 2015, and contracts for the previous bid of Round Two expire on June 30. Here’s how Round Two will play out for the year:

- Winter 2016 — CMS announces single payment amounts, begins contracting process.

- Spring 2016 — CMS announces contract suppliers, begins contract supplier education campaign.

- Spring 2016 — CMS begins supplier, referral agent, and beneficiary education campaign.

- July 1, 2016 — Implementation of Round Two re-compete and the national mail-order re-compete contracts and prices.

Notably, CMS altered the re-bid so that CBAs that were located in multi-state MSAs have been re-defined so that no CBA is included in more than one state. A list of the ZIP codes included in each CBA is available on the CBIC website (dmecompetitivebid.com).

For the 2017 re-bid of Round One, bidding began on Oct. 15, 2015 and closed on Dec. 16, 2015. After that, CMS has set the following tentative dates:

- Winter 2016 — Preliminary bid evaluation notification.

- Summer 2016 — CMS announces single payment amounts, and begins contracting process.

- Fall 2016 — CMS announces contract suppliers, begins contract supplier education and begins beneficiary, referral agent and supplier education.

- Jan. 1, 2017 — CMS implements contracts and prices for the Round One 2017 re-compete.

But perhaps the most notable aspect of Round One 2017 was discovered by Kim Brummett, vice president of regulatory affairs for the American Association for Homecare: the 2017 re-compete’s contracts are significantly shorter than previous installments.

Specifically, Round One 2017 contracts are listed as lasting only two years instead of the three years seen in other rounds. A statement from AAHomecare noted that the change lines up the close of Round One 2017 contracts with the close of Round Two, which close on Dec. 31, 2018.

“What this means is unclear, but hopefully it is a signal that CMS is thinking more strategically about the future of the program,” Brummett remarked last year after discovering that fact. “With rates already bottoming out, it is hard to imagine the long term sustainability of the program in its current format.”

Complex Rehab

Complex Rehab

The already critical issue of protecting rural providers from CMS’s bid expansion took on enhanced significance during 2015, and the outcome for that issue is also very much undetermined as this issue goes to press: protecting complex rehab technology.

CMS’s expansion of competitive bidding intended to apply competitive bidding pricing to as many as 171 wheelchair accessory HCPCS codes on Jan. 1. Applying the bid rates would result a roughly 45 percent cut in reimbursement for these items, and would significantly harm revenue for rural providers, which would likely be unable to recoup the loss. If those businesses shutter, so to would access for their rehab patients.

Also, it’s important to note the word “accessory” is a misnomer in that it implies those items are unnecessary and aren’t needed. Clearly, in the realm of CRT, that is not the case. CRT accessories are needed items that ensure a patient can properly use his or her chair and receive its intended therapeutic benefit. CRT accessories aren’t options; they’re vital to the use of the chair.

Even more vexing is the fact that many in the industry aren’t sure CMS is even permitted by law to do this. When Congress passed the Medicare Improvements for Patients and Providers Act (MIPPA) in 2008, the main thing the law did was delay CMS from going through with Round One of competitive bidding. But it also did one other critical thing: it protected CRT from competitive bidding. CRT was carved out of the program. But CMS went ahead with the plan, because MIPPA doesn’t specifically list CRT accessories, as opposed to chairs, so apparently CMS didn’t think the MIPPA carve out applied.

Ultimately, the issue is a “language vs. spirit of the law” argument, and CMS pushed forward with its plan. So up until this issue went to press, providers and industry advocates were working hard to advance legislation that would protect accessories for complex rehab wheelchairs. There were two bills that the industry was trying to get passed: H.R. 3229, launched into the House by Rep. Lee Zeldin (R-N.Y.) to protect CRT from the expansion of competitive bidding; and S.2196, launched into the Senate by Sen. Robert Casey (D-Pa.) with Sens. Rob Portman (R-Ohio), Chuck Schumer (D-N.Y.) and Thad Cochran (R-Miss.) as original co-sponsors for the legislation. The bills provide a technical correction that restricts CMS from applying Medicare competitive bidding program pricing to the accessories used with complex rehab wheelchairs.

At press time, like the legislation to reform the bid expansion as a whole, providers, association and legislative experts were pushing hard to advance the CRT accessories carve out. And, like the bid expansion reforms, HME Business is crossing its fingers for success. We hope that by the time you read this, that the industry succeeded, because access to adequate healthcare for some of the most vulnerable patients in the United States is at risk.

Audits

Audits

Any providers looking for relief from Medicare claims audits won’t have much to look forward to this year. CMS’s intense focus on Medicare claims audits will most assuredly remain a broken system for 2016. The recoupments are simply too good for the agency.

But savvy providers know that when CMS trumpets its recoupments to Congress, it’s only telling half the story, as the number of claims backlogged at the Office of Medicare Hearings and Appeals continues to spiral out of control. In fact, there has 2122 percent increase in DMEPOS-related audit appeals over past eight years, according to the American Association for Homecare.

Because the contractors hired by CMS to carry out its various audit programs have recouped claims on minor technicalities and through inconsistent (some say capricious) interpretations of the DME MACs’ LCDs, there has been a massive level of appeals. And providers have been winning those appeals, especially once they work their way through the system to the point that OMHA has to assign a federal Administrative Law Judge.

As a result, the number of appeals reaching the ALJ level skyrocketed. While OMHA received 1,250 appeals a week in January 2012, it received more than 15,000 appeals a week by November 2013. By the start of 2014, OMHA had a backlog of 357,000 appeals waiting for ALJs, and OMHA Chief Judge Nancy Griswold announced OMHA would delay assigning an Administrative Law Judge to any new audit appeal by two years.

Since that time, things have gotten worse. The OMHA web site now puts the average turnaround time for appeals at 765 days. The last bit of backlog news in mid 2015 was that the number of claims waiting for an ALJ had surpassed 600,000, and by the end of 2015 the general industry discussion was estimating that the backlog was skirting the 1 million-claim mark.

What this means is that for 2016 providers can expect more frustration and delay when it comes to the audit appeals process. It is hoped that the industry will advance legislation to reform CMS audit reforms. In the meantime, providers can help by providing detailed information to the American Association for Homecare’s Audit Key initiative, which goes live in 2016. The initiative will generate the data that will help advocates make their case on Capitol Hill. Learn more and register at bit.ly/auditkey.

Retail

Retail

For several years, this publication has loudly beat the drum for retail HME/DME sales, and with good reason: retail sales stand as the no. 1 way in which providers can diversify and expand their revenues in ways that leverage their product and care expertise, as well their existing client and referral partner relationships. Moreover, retail lets HMEs drive new revenues in ways that are largely free of the complications associated with Medicare.

And, as providers have expanded into retail/cash sales, they are continuing to sharpen their game. As we enter 2016, we will see providers shape increasingly savvy retail sales strategies. One key way they will do that is through smart financials. Providers are now paying closer attention to their accounting, inventory, margin markups, and pricing. And what they are finding is as sales increase and market share grows, so does the importance of monitoring, measuring and reacting to retail finance data. Small adjustments can foster major change. A slight tweak to pricing or inventory can be the difference between posting a profit or a loss.

In particular, providers are starting to regularly monitor their inventory turns. Retailers must excel at turning inventory over and quickly selling. If a provider racks up unsold inventory, it’s not making a profit, and it won’t succeed. So providers are closely tracking inventory turns to ensure they are maintaining a profitable balance between their inventory level and your sales. They can track your inventory turns at the company level, store level and even down to the item.

Also, providers are placing a greater emphasis on how they pursue retail sales online. This doesn’t necessarily mean offering e-commerce, either. Simply creating online and social media presences that support the in-store retail sales is a more complex and nuanced effort than many providers initially anticipated. Patients are engaging in heavy online research prior to purchasing DME, and they are looking for providers to provide the information they need. Moreover the onus is on providers to put dedicated social media efforts into play that foster and expand patient relationships so that they have a positive presence in an increasingly competitive retail DME marketplace.

Over the next 12 months we can be sure that more providers will rely on retail sales and they will be implementing smarter ways to pursue those revenues.

Diversification

Diversification

As any experienced provider now knows, an industry that once depended on Medicare reimbursement for 80 percent of its revenues, is now trying to do everything it can to distance itself from that funding source.

As a result, we have seen providers try to diversify their revenue streams, and the ways in which providers accomplishing that are growing increasingly savvy. Let’s take cash sales, for instance. It’s not enough for providers to focus on just retail sales; now they are exploring specialty niches that help them establish a unique appeal to patients and referral partners.

A primary example of this would be home access. Starting with simple items, such as threshold ramps or bath safety items, provider can gain a foothold in a cash category that appeals to a wide number of patient relationships they likely already have through the funded side of their business. Then, as the provider builds a reputation, the provider can start gaining increased expertise and capability and add products and services such as ramp or lift installations to their repertoire. Other examples of this sort of retail niching that leverages existing relationships with funded patients include businesses that focus on specifically service seniors or wound care patients.

Another example of leveraging existing relationships and product expertise are providers that are trying to serve an increased number of institutional care settings, such as hospitals, residential care facilities or nursing homes. While these environments are not homes, there do need equipment such as beds, support surfaces, wheelchairs and other items providers are already offering.

And there are care services that providers can diversify into, as well. For instance, senior care services or non medical homecare services let providers tap into their existing relationships to offer a whole new range of services — and of course they can start providing DME to the new clients they attract through to those types of services. And this sort of arrangement doesn’t necessarily have to be homegrown, either. HME businesses can partner up with existing providers of these sorts of care services to mutual benefit.

The point is that 2016 will continue to see increased creative thinking on the part of providers to redefine their businesses in an out-of-the-box fashion. The onus is on provider management and owners to think creatively about how the can leverage their existing business assets and patient and referral partner relationships.

Mergers and Acquisitions

Mergers and Acquisitions

There’s no use in beating around the bush, so we’ll plainly say it: Mergers and acquisitions are a fact of life in today’s HME market. There are providers that want or need to sell their businesses, and there are providers and a increasing number of buyers from outside the industry who are looking to buy.

In fact, according to VGM Group Inc. chief financial officer Mike Mallaro, more than half of the 17 percent drop off in the number of HME provider businesses can be attributed to merger and acquisition activity.

Also the industry boasts attractive demographics. For instance at 76 million people, the Baby Boom is retiring at the rate of 8,000 people a day, and many of those Baby Boomers are will to pay retail for DME items if they can’t get Medicare to fund them.

Not surprisingly, over the past two years, M&A activity has steadily ramped up, and in interesting ways. For instance, in addition to seeing the complete sale of a total business, we are seeing transactions in which a provider sells only certain business lines to a buyer, while retaining others. One provider might want to buy a second provider’s fee-for-service business, and that second provider might be happy to keep its retail business.

And of course competitive bidding has added a whole new dimension to HME M&As as providers look at Medicare contracts as key assets that have strategic significance. A provider specializing in specific categories in specific geographies might be keen to expand through well-through-out purchases.

This means that HME providers must understand how M&As work, and how they might fit into their business strategies, either as a buyer or a seller. HME providers must understand specifics such as the difference between asset and stock purchases, or how to value a business in order to determine the ideal sales price.

Information Technology

Information Technology

From day one, we’ve identified information technology as the pivotal business asset that providers will use to increase efficiency, decrease cost, shore up margins, adapt, and capitalize on new trends in not only the industry, but healthcare as whole.

So it should come as no surprise that we see software and IT as continuing to play a major role in the industry over the next 12 months. And it certainly has over the past year. During 2015 we saw providers prepare for and adopt ICD-10 for Medicare claims coding; intensify their business performance monitoring and optimization via IT; and leveraging software to make their businesses more nimble and capable of managing change.

This year we will see providers continue to leverage their software strategically, but we will also software companies in the industry and providers respond to the key issue of healthcare IT interoperability. Various software companies operating in different niches of healthcare have realized that because there are so many disparate systems used by their different users, the resulting technology landscape has become balkanized. Moreover, at a time when the emphasis is on sharing information to improve outcomes, those IT companies must reverse that trend.

So various initiatives to foster healthcare IT interoperability have sprung up over the past few years, and now the industry’s software companies are starting to respond. With increased interoperability providers will not only be able to take advantage of efficiencies such as increased documentation, billing and claims efficiency, but they’ll also start to take advantage of the increased communication for business or care benefits.

For instance, a provider could share data on how a sleep or oxygen patient is faring with his or her treatment and that would not only help the physician customize the patient’s therapy, but establish the provider as a useful resource for ensuring optimal outcomes.

As the year progresses, providers will definitely want to watch how the industry’s software systems better connect them with their referral partners, and how they can take advantage of that increased connectivity.

Outcomes-Oriented Care

Outcomes-Oriented Care

We know that outcomes will define American healthcare. At the public policy level, Medicare has clearly communicated its emphasis on the cost-to-outcomes ration, so much so that it has been establishing accountable care organizations (ACOs). ACOs are groups of healthcare providers that provide end-to-end healthcare solutions that focus on optimizing patient outcomes for the lowest price.

Medicare established guidelines establishing ACOs in the 2010 Patient Protection and Affordable Care Act. The Act lets CMS set up the Medicare Shared Savings program, which lets it extend contracts to ACOs to provide services to Medicare Part A and Part B beneficiaries. In terms of number, Medicare has reported that there were 32 ACOs in December 2011, and now, just five years later, there are nearly 400 ACOs in the United States.

What does this mean for providers? While ACOs might not be an immediate part of their marketplace, there will be a need for providers that can help their referral partners optimize care to ensure good outcomes at lower cost. Bearing this in mind, providers need to look at ways they can demonstrate. Not only will this help patients, but it will give providers a business opportunity by differentiating their services and positioning themselves as a key player in the healthcare process.

The key to accomplishing this lies in managing and monitoring patients. Sleep is an example of there this has come to the fore. Using a variety of communications methods and remote monitoring innovations integrated into PAP therapy devices, sleep providers serve as information conduits to the physicians and other sleep professionals involved in patients’ care. We’re also seeing this happen in diabetes care as blood glucose monitors collect more and more information.

We believe more of the HME market is headed in this direction. For instance, oxygen could easily be the next arena where providers can provide detailed therapeutic information that helps their partners optimize care and outcomes. As 2016 unfolds, providers will nee to consider how they can create businesses that cater to their partners’ emphasis on outcomes-oriented care.

Cost Efficiencies vs. Care Quality

Cost Efficiencies vs. Care Quality

Ultimately, many of these trends rotate around hard numbers — revenues, profit margins, efficiency, inventory overhead, etc. Truly, providers are looking at the details in order to ensure they create businesses strategies that can survive and thrive in a downright hostile Medicare funding environment.

But the ultimate mission of providers is to give patients care. As a result, those two priorities — care and cost — wind up being at loggerheads with one another. Providers want to provide good care, but doing so means additional cost, which is often unacceptable in a business where revenues are on the decline and margin is everything.

Perhaps no sector of the industry has felt this more than respiratory, where oxygen providers have had to cut down on labor and time-intensive practices such as frequent follow-up visits from clinical staff. If anything, it’s a conundrum: you need to be profitable in order to provide care, but in order to be profitable, you need to cut back on the things that enhance care.

But oxygen providers are also showing that it doesn’t necessarily have to be that way. They are working to drive efficiency and cut costs as much as possible from the portions of their businesses that aren’t care-related in order to make additional investments in the portions of their business that are. Also, they are taking advantage of products and technologies, such as portable oxygen, that increase care and outcomes, while driving down overhead costs, such as deliveries.

Moreover, they are learning that the care they offer can pay dividends in the form of enhanced relationships with their referral partners. As those partners are under pressure to demonstrate outcomes to their funding sources, providers can track their care and document patient successes to differentiate their businesses.

To be certain, balancing care and cost will be a key issue in 2016. Achieving that balance not easy, but as some corners of the industry have demonstrated, it doesn’t necessarily have to be a zero sum game, either.

This article originally appeared in the January 2016 issue of HME Business.