Respiratory Survey 2015

Bracing for the Re-Compete

Our sixth annual Respiratory Therapy Survey illustrates respiratory providers’ concerns about competitive bidding, the Round Two Re-Compete and its impact not only on their businesses, but the care patients receive.

- By David Kopf

- Mar 01, 2015

The respiratory care sector appears to be bracing for the big one. As Round Two of competitive bidding is in the process of a re-compete, and respiratory providers continue to struggle with CMS’s audits, Medicare policy continues to influence not only the business of respiratory services, but also nearly all aspects of providing respiratory care to long-term oxygen therapy patients. That’s why it’s important to keep a bead on what respiratory therapy professionals are thinking and feeling about their situation. With that in mind, it’s time yet again to review the results of Respiratory Management’s sixth annual Respiratory Therapy Survey.

Obviously competitive bidding is the overriding factor in the extremely cost-conscious environment of oxygen services. So much so that 36.2 percent of the respiratory professionals responding to our survey cited it as the biggest threat facing their industry.

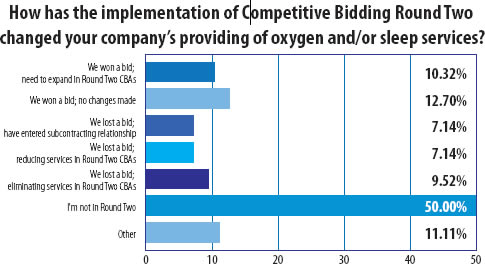

Of the providers responding, 40 percent said they were bidding in the re-compete of Round Two of competitive bidding. When it comes to last bid of Round Two, it’s clear the program has had a considerable impact. Half of the respondents replied that they were in Round Two. Ten percent said they won bids and needed to expand into Round Two; 12.7 percent said they won bids in Round Two CBAs in which they were already operating; 7.1 percent said they lost and had entered a subcontracting relationship; another 7.1 percent said they lost and were reducing services; and 9.5 percent said they lost and were cutting services.

“We service two CBAs, Boston and Worcester, and are located right at the dividing line,” one respondent commented. “We lost the bid for O2 in Worcester and won O2 in Boston and the reverse happened with CPAP. So customers we had been servicing in the next town over, that were very happy with service, were lost.”

“We had patients on the outer fringe we can no longer service,” another wrote. “They must now use providers that are further away — i.e, some pass our office on the way home daily.”

When it comes to subcontracting, it is clear that most providers do not see such an arrangement as a feasible business model for oxygen bidders that did not win contracts in Round Two. All told, 71.5 percent thought it was an unworkable business model, while 28.5 percent thought that it could work. A similar breakdown was found for sleep services. Of sleeprelated providers replying, 72.4 percent said that subcontracting was unfeasible, and 27.6 percent said it was a workable arrangement.

Obviously providers that didn’t win contracts needed some kind of plan to stay in business. Twenty-eight percent of providers replying said they did not win a Round Two contract and had come up with contingencies. Some of those providers offered useful insights:

“We expanded our showroom and shifted more business to retail,” a survey taker stated. “Sub-par services for O2 and sleep performed by bid winners in our area resulted in referral sources carving out all other insurances to us.”

“We are pursuing the commercial insurance patients that can no longer be served in a timely manner by the other companies that are serving the Medicare bid patients,” another noted, “as well as cash sales by anyone not willing to jump through insurances ‘hoops’ to get coverage.”

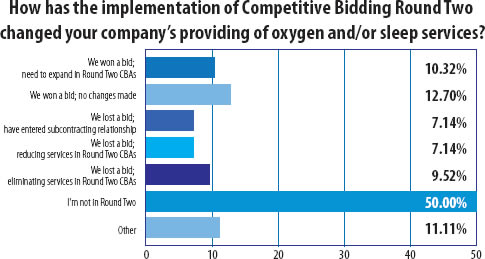

Needless to say, the current situation was not viewed by most of our survey-takers. Slightly more than 24 percent of them were convinced that competitive bidding was here to stay. This chart provides even more insight:

Comments from respondents also indicated that respiratory providers had many well-considered opinions on what needs to happen in the fight to stop a bid program that has so damaged the respiratory business.

“Competitive bidding has been unsuccessful in every aspect,” a respiratory professional wrote. “Although the government may have saved a little money up front, in the long run, they are spending more money. The bid winners cannot possibly keep up with the demand and provide the type of service beneficiaries need. The result? Very poor care leading to more health problems and more hospitalizations.”

“I believe that if and only if the public is willing to voice their dissatisfaction, then there might be a possibility that the politicians will be more inclined to do something about competitive bidding,” one survey taker replied. “The industry’s effort, while applaudable, is unfortunately not being taken as seriously as one would hope.”

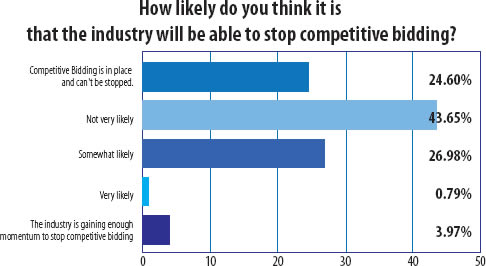

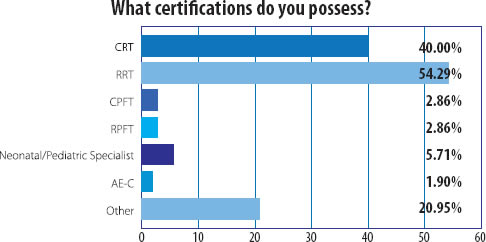

When it comes to respiratory and sleep care, the respondents to our sixth annual survey were a seasoned bunch. In terms of certifications, 54 percent of respondents were RRTs and 40 percent were CRTs. And in terms of experience, a whopping 77 percent had worked as respiratory therapists for more than 15 years. Clearly, these are people who committed to their service and patients. Similarly 56 percent replied that they had 15 or more years working as an RT in the homecare setting.

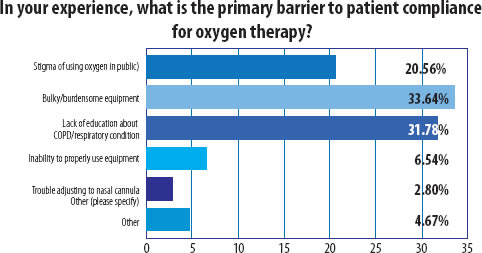

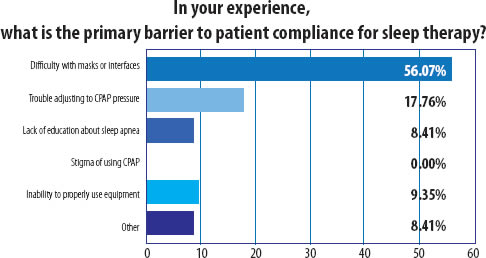

And when it comes to care, many of these experienced and qualified individuals noted various barriers to patient compliance to oxygen and sleep therapy. For oxygen therapy compliance, the two key barriers that were almost neck and neck were burdensome equipment and lack of education, while mask fit and difficulty with masks reigned supreme as the biggest trouble point in sleep therapy compliance.

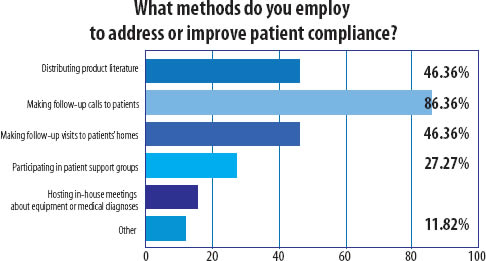

Our respondents also had clear ideas on how to improve patient compliance. Key among those techniques were follow-up calls and follow-up meetings. Support groups and other tools were similarly important. In other words, compliance is an ongoing effort.

Several respondents also added that education was key. “Provide good education on the front end to reduce or eliminate ongoing calls and visits,” on survey-taker wrote. Another suggested, “outside education at home health or hospice.”

And in a very telling comment regarding the impact of reimbursement cuts, another commenter posted, “We used to provide support groups and meetings, but the decrease in reimbursement across the board and competitive bidding put an end to that service.”

Bearing that in mind, it is no reason that respiratory and sleep professionals are bracing themselves for the Round Two re-compete. Care quality is at stake, and it’s an issue our survey-takers clearly care about and take seriously.

This article originally appeared in the March 2015 Respiratory Management issue of HME Business.

About the Author

David Kopf is the Publisher HME Business, DME Pharmacy and Mobility Management magazines. He was Executive Editor of HME Business and DME Pharmacy from 2008 to 2023. Follow him on LinkedIn at linkedin.com/in/dkopf/ and on Twitter at @postacutenews.