2014 Oxygen Market Survey

Life Under Round Two

Respondents try to find the bright spots living under Round Two of competitive bidding.

- By Joseph Duffy

- May 01, 2014

As HME providers undertook Respiratory & Sleep Management’s sixth annual oxygen market survey, they do so after experiencing life under Round Two of competitive bidding in 91 metropolitan areas since July 2013. In addition, Round One re-compete rates in nine competitive bidding areas went into effect Jan. 1.

Competitive bidding Round Two payment rates vary by each of the bid areas and by HCPCS codes, but overall, the payment reduction for the oxygen category (which includes numerous HCPCS codes) is approximately a 40-percent reduction off the 2013 Medicare fee schedules, says Joe Lewarski, vice president of Clinical Affairs, Invacare Corp. This, coupled with the continuous stress of audits, seemed to put providers in an expressive mood as the annual survey experienced a spike in its typical number of respondents.

Fee schedule cuts and the length of time working under Round 2 may be why there was a drop in oxygen business growth reported this year. Last year, About 66.9 percent of respondents, up from the previous year’s 61.2 percent, said that their oxygen business has grown in the past 12 months, with many respondents (39 percent) experiencing growth between 6 percent and 10 percent. This year, 53.1 percent of respondents reported oxygen business growth. And with that said, 59.2 percent said they aren’t considering exiting the oxygen business by 2015 because of competitive bidding, audits, the rental cap or other Medicare cuts. Last year, 57.3 percent of respondents said they were not leaving the oxygen business in 2014 due to the same reasons.

Fee schedule cuts and the length of time working under Round 2 may be why there was a drop in oxygen business growth reported this year. Last year, About 66.9 percent of respondents, up from the previous year’s 61.2 percent, said that their oxygen business has grown in the past 12 months, with many respondents (39 percent) experiencing growth between 6 percent and 10 percent. This year, 53.1 percent of respondents reported oxygen business growth. And with that said, 59.2 percent said they aren’t considering exiting the oxygen business by 2015 because of competitive bidding, audits, the rental cap or other Medicare cuts. Last year, 57.3 percent of respondents said they were not leaving the oxygen business in 2014 due to the same reasons.

Other survey highlights include:

- 33.3 percent of respondents said pre- and post-payment audits was the greatest challenge for their oxygen business over the last 12 months. Last year, pre- and post-payment audits led the same question at 27.1 percent.

- 29.1% of respondents named competitive bidding (Round Two, Round One or both) as the greatest challenge for their oxygen business over the last 12 months.

- 91.8 percent of respondents who were in Round Two bid on oxygen services and 46.6 percent reported being awarded a CMS contract that they accepted.

About the respondents’ oxygen business

A slight majority of respondents (39.2 percent) said their primary job is respiratory service manager. The rest are largely made up of respiratory HME business owners (38.7 percent), respiratory therapists at a homecare company (19.4%) and respiratory therapists at a hospital (2.8%).

Most of the respondents (71.1 percent) have a program to service traveling oxygen patients. This is down from last year, which was just under 76 percent. Of those with a program to service traveling oxygen patients, 33.3 percent said their business model is a mixture of equipment options with emphasis on transfilling systems and/or POCs, 29.9 percent said a mixture of equipment options with an emphasis on oxygen cylinder delivery, and 25.4 percent said stationary concentrators and oxygen cylinder delivery only.

Factors that influenced respondents’ choice of business model for oxygen delivery include:

- 43.8 percent said patient preference has influenced them, while 13.1 percent said it has not influenced them.

- 56.7 percent said cost has highly influenced them, while only 1.7% said cost has not influenced them.

- 31.4 percent said RT preferences have influenced them, while 28.6 percent said they have somewhat influenced them.

- 33.3 percent said physician order/prescription for a specific device has influenced them, while 33.3 percent also said it has somewhat influenced them.

- 47.1 percent said the 36-month cap has highly influenced them, while only 4 percent said it has not influenced them.

- 48.5 percent said competitive bidding Round One was not applicable, while 20.7 percent said it has highly influenced them.

- 39.3 percent said competitive bidding Round Two was not applicable, while 32.7 percent said it highly influence them.

Of the 53.1 percent of respondents reporting oxygen business growth, 33 percent said their oxygen business grew somewhere within the range of 6 percent to 10 percent, compared to just over 39 percent for this range from last year’s survey results. Another 24.5 percent said their business growth fell in the range of 11 percent to 15 percent.

The majority of respondents (54.5 percent) said their growth was attributed to an increased number of patients due to referral sources. This was the most cited factor last year as well with a response rate of 63.2 percent. Business expansion with additional locations and addition of a retail showcase both received response rates of 1.1 percent.

Regarding business contraction, 41.8 percent reported less than 5 percent contraction of their oxygen business, while 13.9 percent said they contracted from 6 percent to 10 percent. And 11.4 percent said their oxygen business contracted over 40 percent. Of those respondents reporting contraction, almost 30 percent placed the blame on a decreased number of patients due to not winning a competitive bid contract, while 26 percent said it was from decreasing Medicare funding due to rental cap or other developments with Medicare funding.

And according to respondents, the drastic Medicare funding cuts have resulted in the following challenges, in order of response percentage:

- Maintaining customer service (34 percent)

- Delivering equipment/oxygen cylinders (28.4 percent)

- Maintaining respiratory therapist services (18.5 percent)

Round Two of Competitive Bidding

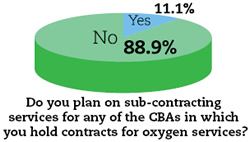

Of all the respondents in a Round Two bidding area, 91.8 percent bid on oxygen services, and 46.6 percent were awarded contracts for oxygen services. Almost 80 percent of bid-winning respondents have a location in all the bidding areas in which they won, while all bid-winning respondents reported having all state specific licenses, certifications and accreditations for the areas for which they were awarded contracts.

Bid-winning respondents were asked if they expect their Round Two contract(s) for oxygen services to expand their business. A majority (66.7%) said that they expect their business to expand from 0 to 6 percent, while 29.6 percent of respondents said their business would expand somewhere in the range of 21 percent to 40 percent.

Bid-winning respondents were asked if they expect their Round Two contract(s) for oxygen services to expand their business. A majority (66.7%) said that they expect their business to expand from 0 to 6 percent, while 29.6 percent of respondents said their business would expand somewhere in the range of 21 percent to 40 percent.

For those respondents who did not win a bid or refused a contract, 44.8 percent said the loss of oxygen services would impact business revenues in the range of 21 percent to 40 percent. The second highest range of impact was 0 to 20 percent, which had a response of 37.9 percent. For those losing oxygen services, 34.5 percent said they are forced to seriously consider selling their business.

How will respondents try to diminish the impact of losing oxygen services in their bidding areas?

- 62.1 percent of respondents will increase referrals from private payor insurance carriers.

- 44.8 percent will increase other lines of Medicare

DME not impacted by Round Two.

DME not impacted by Round Two.

- 41.4 percent will use retail sales.

- 34.5 percent will decrease staff.

- 24.1 percent will use subcontracting.

Audits

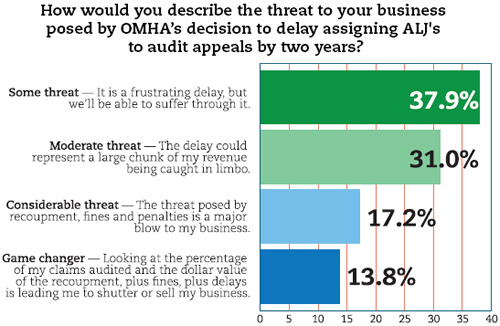

After beating out the 36-month oxygen cap in last year’s oxygen survey for the infamous mention of greatest challenge to oxygen business, pre- and post-payment audits received a majority response (33.3 percent) again this year. Audits were also mentioned by 9 percent of respondents as a factor that most contributed to oxygen business contraction. Audits are also named by 18.3 percent of respondents as part of the reason oxygen providers are considering exiting the oxygen business by 2015.

When asked what percentage of your claims (approximately) have been impacted by pre- or post-payment audits, half of all respondents said that number was somewhere in the range of 0 to 20 percent. Almost 11 percent of respondents said 61 percent to 80 percent of their claims have been affected by audits. With that said, 37.9 percent of respondents said that they have appealed and successfully overturned 0 to 20 percent of their audited claims.

Treatment

The primary diagnosis of oxygen patients is COPD, according to 88 percent of respondents. When patients do not have COPD, respondents said the most common diagnoses are congestive heart failure (45.5 percent), sleep apnea (19.3 percent) and pulmonary fibrosis (6.3 percent).

What do COPD patients want most? According to respondents, access to portable technology (72.4 percent), more comfortable therapy (14.7 percent), clinical education about COPD (3.1 percent) and monitoring equipment to regulate the disease (3.1 percent).

“Clinical education is a huge gap for customers,” says one survey taker. “We provide COPD education, but many don’t within our area. We can’t expect patients to manage, what they don’t understand.”

This article originally appeared in the May 2014 Respiratory & Sleep Management issue of HME Business.